property tax assistance program illinois

Find Out If You Qualify. If you are a taxpayer and would like more information or forms please contact your local county officials.

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

Internet Filer Eligibility Qualifications.

. The homeowner will need to pay each and every monthly or quarterly installment. Ad This is the newest place to search delivering top results from across the web. Seniors with income of less than 45000 a year.

We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. You may be eligible to receive financial assistance for the following. Who is Eligible for Property Tax Assistance.

Ad Apply For Tax Forgiveness and get help through the process. 31 rows Purpose of the Property Tax Relief Program. Electronic Filing Program Via Internet.

Lake County property owners will receive their property tax bills as scheduled and be expected to pay them by June 8. The property must be occupied for 10 continuous years or 5 continuous years if the person receives assistance to acquire the property as part of a government or non-profit housing program. This exemption limits EAV increases to a specific annual percentage increase that is based on the total household income of 100000 or less.

On July 1 the Illinois Family Relief Plan takes effect in the tune of an estimated 18 billion. Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families. So if a propertys EAV is 50000 its tax value would be 40000.

Additional grant programs and access to loans can assist your business with working capital machinery and equipment land acquisition building. However please note that beginning FY 20 any recipient of the PTRG will need to file the abatement for 2 years. Content updated daily for property tax relief illinois.

This help comes in the form of income and. Pritzker Administration Announces 309 Million Assistance Program for Illinois Homeowners Impacted by COVID-19. Districts must apply annually if they wish to be considered for the future grant cycles.

Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing. To qualify for this type of credit you have to own and reside in the property. The state of Illinois is providing a property tax rebate in an amount equal to the lesser of the property tax credit you could qualify for 2020 property taxes payable in 2021 or 30000.

Ad Do You Need To Set Up An Illinois State Payment Plan. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. You can use the Illinois Property Tax Credit on your income tax return.

CHICAGO Governor JB Pritzker and the Illinois Housing Development Authority IHDA today announced the Illinois Homeowner Assistance. The County Board decided against delaying the collection of taxes or waiving. The Illinois Department of Revenue does not administer property tax.

It is managed by the local governments including cities counties and taxing districts. Do You Need To Set Up An Illinois State Installment Plan. Homeowners with household incomes less than 150 of the Area Median Income.

This credit equals five percent of the Illinois Property Tax you need to pay for your residence. The rebate follows the same criteria as the property tax credit allowed on Form IL-1040 Illinois Individual Income Tax Return and cannot exceed 30000. The homeowner or homestead exemption allows you to take 10000 off of your EAV.

The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a financial hardship caused by the COVID-19 pandemic. Ad Real Tax Solutions For Real People. The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges.

I hope this information helps you Find. CAAs may partner with local governments community-based organizations and the private sector to provide services. Illinois offers a competitive range of incentives for locating and expanding your business including tax credits and exemptions that encourage business growth and job creation.

The Illinois Property Tax Credit Can Help You Reduce Your Taxes. The amount of tax relief is relatively minor. We Have A Three-Phase Tax Relief Program That Shows Better Results Than Any Other Firm.

The Property Tax Assistance Program provides assistance to individuals or families who are delinquent on property tax payments. Search for jobs related to Property tax assistance program illinois or hire on the worlds largest freelancing marketplace with 21m jobs. To see if you qualify give us a call today at 312-626-9701 or fill out the form below to have one of our representatives give you a call.

Find Out Now If You Qualify. Mayor Rahm Emanuel and the Chicago City Council are implementing this rebate program to offset the property tax increase needed to fund the pensions of police officers and firefighters. To apply for property tax assistance you must provide proof that your taxes are delinquent.

General Information and Resources - Find information. I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available. The City of Chicago Property Tax Rebate Program provides working- and middle-class families and seniors some property tax relief through a City-funded rebate.

Property Tax Assistance Will County Illinois. There may be some assistance available for delinquent property taxes in Winnebago County Illinois. The 10000 reduction is the same for every home no matter its market value or EAV.

The applicant will need to be the owner of the real estate property according to the assessors records. Property Tax Grant Determinations. Its free to sign up and bid on jobs.

INCENTIVES AND TAX ASSISTANCE. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. If a home has an EAV of 200000 its tax value would be 190000.

The Property Tax Relief Grant PTRG is a one year grant program.

Cook County Property Tax Bill How To Read Kensington Chicago

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

My Specialization Is In Irs And Illinois Department Of Revenue Tax Problems I Represent Many Individuals And Businesses Tax Lawyer Business Tax Tax Attorney

Property Tax Homestead Exemptions Itep

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

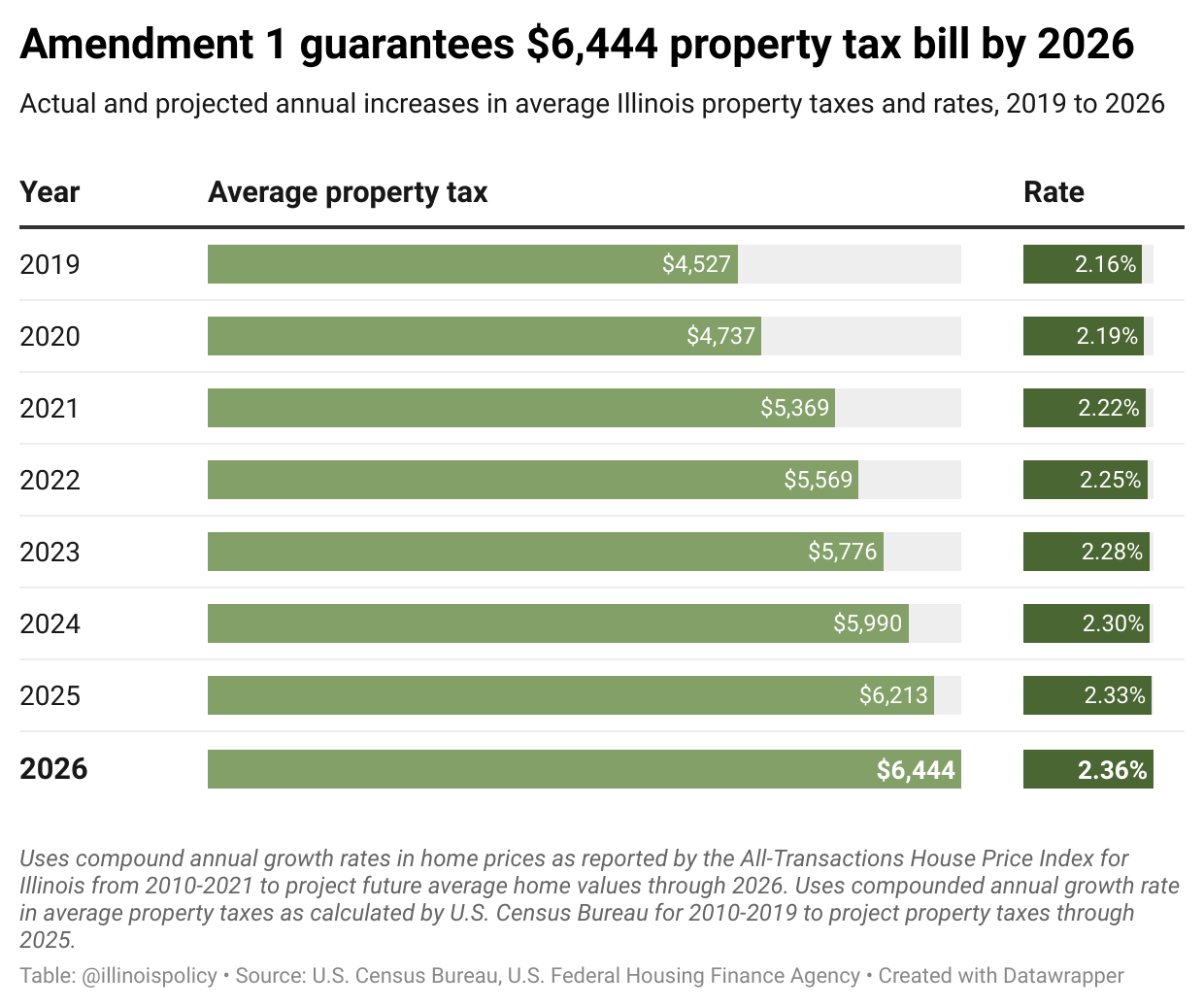

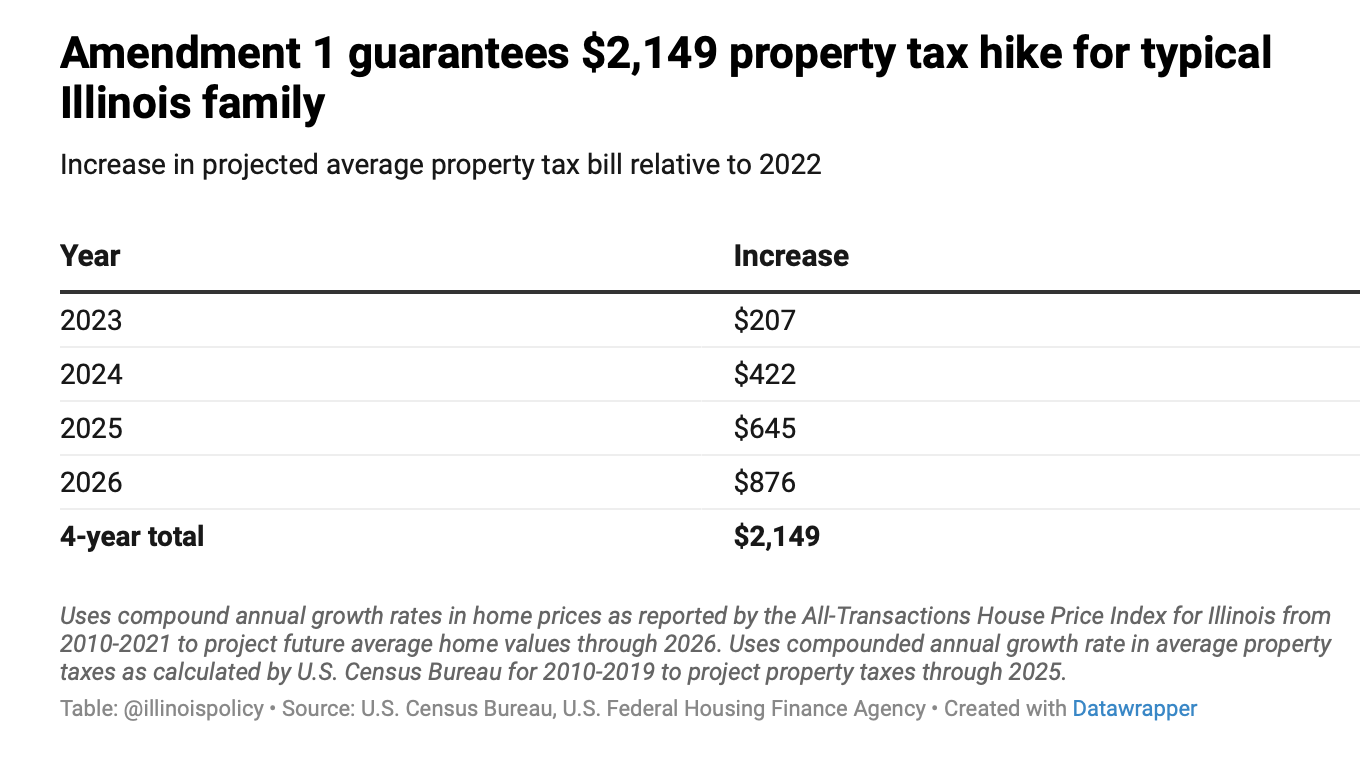

Ep 44 How Amendment 1 Would Raise Your Property Taxes

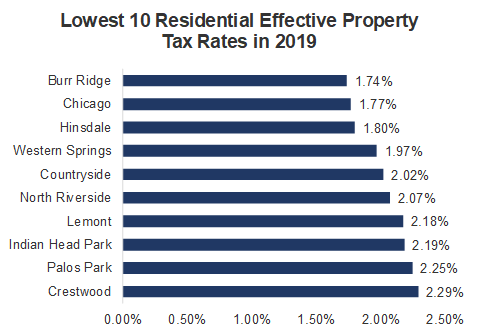

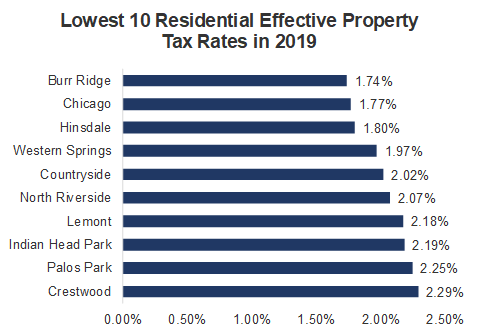

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

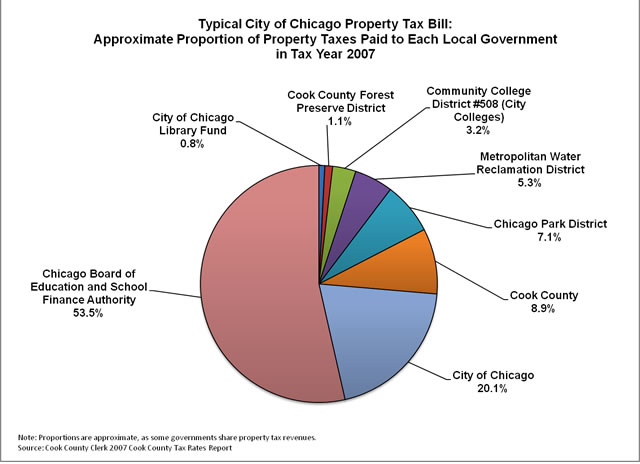

Where Do Your Property Tax Dollars Go The Civic Federation

Property Tax City Of Decatur Il

Property Tax City Of Decatur Il

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

2021 Property Tax Bill Assistance Cook County Assessor S Office

Illinois Property Tax Exemptions What S Available Credit Karma